The government is likely to propose new regulations concerning the functioning of RBI (Reserve Bank of India), according to reports.

The proposal is likely to be brought up in the upcoming board meeting on the 19th of November.

Sources tell that the new regulations could aim at decreasing the control of committee of the central board within the RBI.

This new information comes in the backdrop of the biggest ever turf war between the country’s central banking institution and the govt.

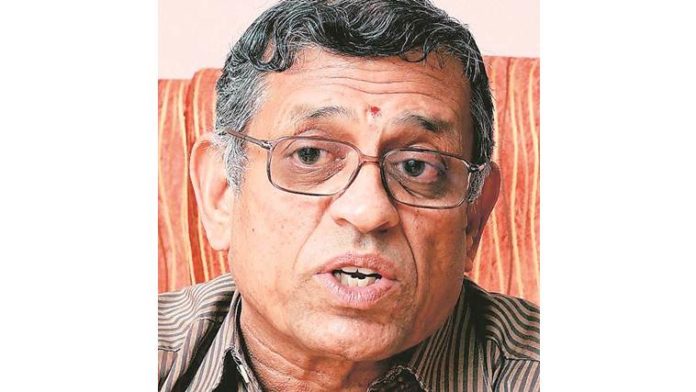

It also comes soon after RBI member and RSS ideologue S Gurumurthy indicated that this tussle is worrysome.

The central bank’s independent director S Gurumurthy said that the capital adequacy ratio is 1% higher than the global Basel norms prescribed in India.

Batting for changes, S Gurumurthy tweeted, “Bank Credit to GDP ratio was down from 10.9% in 2010 to 5.7% in 2015 to 4.8% in 2016. Fiscal deficit also came down in this period.”

Gurumurthy ptiched for easing lending norms for MSMEs (small and medium enterprises), which account for 50% of the GDP of the country.

The board meeting of RBI is scheduled to happen on Monday where the issues raised by the government are likely to come up for discussion, where easing of PCA (Prompt Corrective Action) norms, enhancing credit to MSMEs and cutting size of reserves will be included.

– Harleen Sandhu